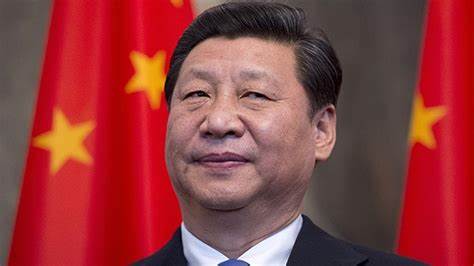

In a world of shifting geopolitical currents, the great decoupling with China is poised to reshape global markets in ways unimaginable. According to a recent article by Financial Times, the aftermath of China's 20th party congress, which saw a consolidation of power under President Xi Jinping, has set the stage for significant changes in economic and investment landscapes. The author, Diana Choyleva, highlights the decisive moves made by Xi Jinping to solidify his control, appointing loyalists to key positions within the party. This power play signals a clear shift towards policies that may not be conducive to foreign investors, leaving markets in a state of uncertainty and caution. Choyleva emphasizes the impending repercussions of this decoupling, especially for multinational corporations heavily reliant on Chinese manufacturing and consumer markets.

With Xi Jinping prioritizing ideology and national security over economic growth, companies face the daunting task of realigning their strategies to navigate this new reality. Furthermore, the author warns of potential backlash from the US, with increased sanctions and scrutiny of supply chains and investments that were once encouraged. This growing rift between the world's two largest economies sets the stage for a fragmented global supply chain, leading to lower productivity and a surge in inflation. As the economic tectonic plates continue to shift, the article underscores the need for investors to reassess their portfolios and prepare for a tumultuous period ahead. With the veils of globalization slowly lifting, opportunities for Western equity investors may arise as capital flows away from China towards more stable and transparent markets.

In essence, the great decoupling with China is not merely a shift in economic dynamics but a fundamental rewiring of the global order. As countries and companies adapt to this new reality, winners and losers will emerge, shaping the future of markets in ways yet to be fully realized.