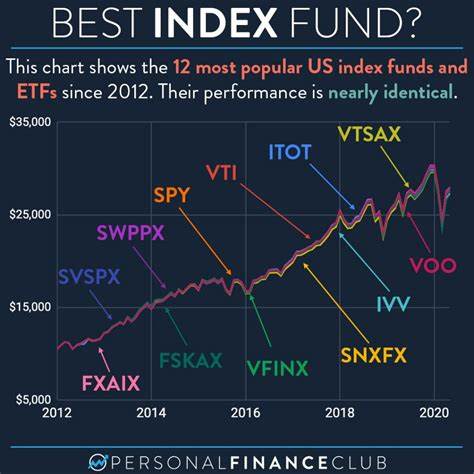

In May 2024, the investment landscape is seeing a surge in interest towards large-cap index funds, regarded as one of the safest equity investments in the stock market. These funds offer investors exposure to established, financially stable companies with potential growth and dividend opportunities, coupled with lower volatility compared to other market segments. Among the top selections highlighted for their performance and reliability are the following six large-cap index funds: 1. Fidelity ZERO Large Cap Index Fund (FNILX): With an impressive expense ratio of 0.00% and a dividend yield of 1.

26%, this fund has shown an average annual return since its inception in September 2018 of 12.23%. 2. Vanguard Developed Markets Index Admiral (VTMGX): This international large-cap index fund boasts an expense ratio of 0.08% and a dividend yield of 3.

37%, with a solid 10-year average annual return of 4.48%. 3. Fidelity U.S.

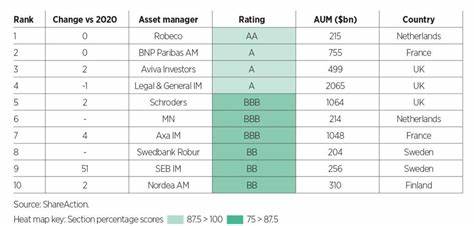

Sustainability Index Fund (FITLX): Investors interested in sustainable investing may find this fund appealing, with an expense ratio of 0.11%, a dividend yield of 1.05%, and an average annual return since its inception in May 2017 of 13.80%. 4.

Schwab Fundamental US Large Company Index Fund (SFLNX): For those seeking value investments, this large-cap value index fund with an expense ratio of 0.25% offers a dividend yield of 1.78% and a solid 10-year average annual return of 10.96%. 5.

Vanguard Dividend Appreciation Index Admiral (VDADX): With an expense ratio of 0.08% and a dividend yield of 1.83%, this large-cap dividend index fund has delivered a 10-year average annual return of 10.87%. 6.

Vanguard 500 Index Fund Admiral (VFIAX): As one of the best S&P 500 index funds, this fund boasts an incredibly low expense ratio of 0.04%, a dividend yield of 1.38%, and a 10-year average annual return of 12.33%. These top-performing large-cap index funds have garnered attention for their competitiveness in the market, with many investors recognizing the potential for steady growth and stability they offer.