A senior citizen in Asheville, North Carolina received a distressing phone call from an imposter posing as a government official from the "Office of the Inspector General". The scammer claimed that the elderly man's personal information was involved in illegal activities, such as drug trafficking and money laundering. Subsequently, he was coerced into transferring a substantial sum of $574,766 from his various bank accounts to a cryptocurrency exchange platform, Coinbase. The fraudulent scheme unfolded when the victim was instructed to purchase a cellphone and a laptop, enabling the scammers to control the latter remotely using the TeamViewer app. Furthermore, they coerced the elderly man to reveal personal information, such as his driver's license, by capturing images through the laptop's camera.

By establishing a Gmail account under his name and manipulating him into liquidating multiple Certificate of Deposits (CDs), the scammers successfully moved the money to Coinbase to purchase 12.16 bitcoins. Interestingly, while the victim’s banks failed to detect the suspicious transactions, it was Coinbase, the cryptocurrency exchange, that eventually intervened. In November, after the bitcoins were shifted to another anonymous Coinbase account, the platform identified the activity as potential elder fraud and took proactive measures to freeze the account. The swift action by Coinbase not only prevented the loss of the senior citizen's life savings but also led to the involvement of law enforcement agencies in dealing with the cybercrime incident.

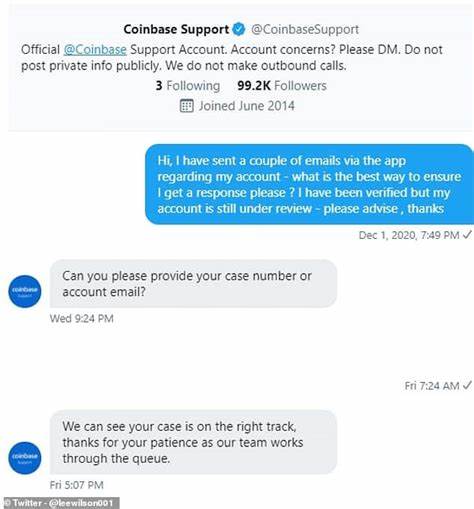

In a recent development, the U.S. Attorney for the Western District of North Carolina filed a petition for forfeiture, which authorized the bitcoin to be safeguarded in an FBI-secured virtual currency wallet with the intent to return it to the victim. Since the bitcoins were purchased at an average cost of approximately $47,000, there is a possibility that the senior citizen might recover more or less than the initial amount scammed, contingent upon the fluctuating value of cryptocurrency in the market. Coinbase, in response to the incident, highlighted its dedicated investigations team that routinely scrutinizes transactions linked to elder accounts due to the prevalence of wire fraud affecting this demographic.

The platform's proactive stance underscored the commitment of reputable cryptocurrency exchanges to uphold regulatory compliance standards and combat illicit financial activities. Furthermore, the episode sheds light on the obligation of all financial institutions, including licensed entities like Coinbase, to report cases of potential “Elder Financial Exploitation” through suspicious activity reports (SARs) submitted to the Financial Crimes Enforcement Network (FinCen). In the fiscal year of 2020 alone, a staggering 62,000 SARs, involving over $3.4 billion in funds, were documented, emphasizing the imperative for stringent regulatory oversight and vigilance in the financial sector. Joseph Ciccolo, the founder of BitAML – a bitcoin and cryptocurrency compliance consultancy, remarked on the distinctive scrutiny faced by crypto exchanges regarding compliance standards in contrast to traditional banks.

While acknowledging the disparities in regulatory expectations, Ciccolo emphasized the unique scrutiny placed on elder account holders by cryptocurrency exchanges, proportionate to their risk profile and susceptibility to financial exploitation. The substantial transfers from institutions like State Employee Credit Union, HomeTrust Bank, and Truist (formerly BB&T and SunTrust banks) underscore the scale of the fraudulent operation targeting the elderly man. While representatives from Truist Bank and the SECU refrained from commenting, HomeTrust Bank remained unresponsive to Forbes’ inquiries, highlighting the pervasive nature of financial fraud and the critical role of advanced security measures in safeguarding vulnerable individuals from exploitation. The collaborative efforts of law enforcement agencies, financial institutions, and cryptocurrency exchanges are crucial in fortifying the financial ecosystem against cybercrime and ensuring the protection of individuals, especially vulnerable populations, from falling prey to fraudulent schemes. The incident serves as a poignant reminder of the evolving landscape of financial crime and the imperative for continuous diligence and regulatory enforcement to mitigate risks and preserve the integrity of the financial system.

As the cryptocurrency market continues to expand, the onus lies on industry stakeholders to bolster security mechanisms, implement robust compliance protocols, and foster a culture of transparency and accountability to uphold the trust and confidence of users in digital financial services. The episode serves as a testament to the pivotal role of proactive intervention, regulatory oversight, and collaborative efforts in combating financial fraud and safeguarding the interests of investors and consumers in an increasingly digitized financial landscape.